Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

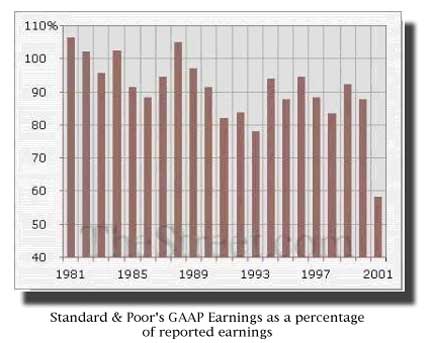

"There's a culture of government corruption... I've never seen a better example of cash-and-carry government than this Bush administration and Enron."-- Ernest Hollings, U.S. Senator It is very strange how our world of politics, of business and of academia, all work in concert under the creed of the big corporations and fortunate sons "Don't do anything unless there is a catastrophe" or paraphrasing Adolf Hitler's creed "people... will more easily fall victims to a big lie than a small one." We have already mentioned that our financial and economic system is a rhetorical and abstract construct of our neoliberal and conservative leadership. And it is commending that a segment of our economists have come out of their ivory towers to be closer to common people. For example, Paul Krugman and James Galbraith have been publicizing the gap between the rich and the poor as they have been writing respectively for The New York Times and The Texas Observer, while Dean Baker and Mark Weisbrot have taken a more activist role in breaking down the myth of the "Free Market." Dean Baker has been repetitively stating that our financial system is a BIG BUBBLE, and in a 1999 article in Dollars and Sense he was warning of the BIG BUBBLE as he pointed out that the value of the Standard and Poor's 500 increased, adjusted for inflation, by 250 percent in the last decade, that is since 1988, the after-tax profits of corporations have risen by almost 80% after adjusting for inflation, and that as a consequence the ratio of stock price to corporate earnings (P/E) went from 15/1 to 33/1.

We also know that the BIG BUBBLE was supported by foreign private investments looking for safe havens in North America, that the BIG BUBBLE was supported by the ever increasing mega mergers of big corporations through corporate buy-outs, that the BIG BUBBLE was supported by the speculative 'buy buy' mantra of financial and investment firms, in practice it was supported by the conspiracy of the "Free Market" to shift wealth from the less rich and poor to the rich and richest. With the collapse of Enron the fundamental problem of the "Free Market" has been diagnosed yesterday by U.S. Senator Ernest Hollings when he said "There's a culture of government corruption... I've never seen a better example of cash-and-carry government than this Bush administration and Enron." Today, our neoliberal and conservative leadership are trying to minimize the corruption of the mantra of the "Free Market" as they fragment the overall decadence of our leadership, and blame the accounting profession for not having enough rules, the banking system for colluding with investment firms, the SEC for not properly supervising our stock markets. Our decadent leadership has created the BIG BUBBLE by preaching all together in concert the gospel of the "Free Market" and now the blame for the creation of the BIG BUBBLE is being diluted to specific professional bodies, specific people, specific agencies, specific scapegoats. The speculative mantra 'buy buy' of the stock market has been supported by such a widespread intrinsic social business corruption, therefore there is not a single culprit for our social and economic problems; the problem is only one, the mantra of the "Free Market," that is the fallacy that the pursuing of our own exclusive selfish happiness concurs with the overall good of society. With the collapse of Enron Corp. everybody is rediscovering the old findings of Dean Baker, that is that the stock market is overvalued. Carl Swenlin, a veteran in the analysis of the stock market, has just learnt of the lie called "pro forma" earnings, that is that the earnings reported by the big corporations are a multiple of the earnings as computed in accordance to General Accepted Accounting Principles (GAAP). And it is not a coincidence that "pro forma" earnings have been the highest ever under this Bush Administration, and therefore, the "pro forma" earnings is another BUBBLE coming out of the rhetorical axis Bush/Cheney. References: Angry lawmakers to subpoena Lay CNN, "There's a culture of government corruption," said U.S. Sen. Ernest "Fritz" Hollings, D-South Carolina, commenting on the Enron matter. February 4, 2002 http://www.cnn.com/2002/LAW/02/04/enron/index.html TOO MUCH OF THE BUBBLY ON WALL STREET?, by Dean Baker, this article originally appeared in Dollars and Sense, October 1999 http://www.cepr.net/too_much_bubbly.htm Lying On Top. "The third quarter is going to be great." by Dean Baker, Counterpunch, January 24, 2002 http://www.counterpunch.org/bakerenron.html Bush's Aggressive Accounting, by Paul Krugman (Krugman gets into the nitty gritty of fraudulent accounting and Bush budget chicanery), Originally published in The New York Times, 2.5.02 http://www.pkarchive.org/column/020502.html S&P P/E 37?!?! REAL P/E IN PERSPECTIVE, by Carl Swenlin, February 2002 http://www.aegeancapital.com/freeservices/archives1/Guests/Swenlin/pg1.htm |