Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

"It is not that humans have become any more greedy than in generations past. It is that the avenues to express greed had grown [in the 90's] so enormously"--Alan Greenspan, Chairman of The Federal Reserve Board, July 16, 2002(1) I have been always leery and perturbed about our sophisticated business gurus telling us how to think and do. I was working in the late seventies and early eighties 'under' the Saskatchewan Health-Care Association (today's Saskatchewan Association of Health Organizations) and realizing that their pension computer system was a corrupt word processing system rather than a processing pension system I asked why so much information requested in input forms was not entered (and not processed) into the pension computer system. I was told that the pension computer system was too sophisticated for me to understand. And guess what, these same business gurus further enhanced the sophistication of their computer systems with the assistance of the big businesses SAP and SAIC and in the process these same two businesses contributed to the sapping and sacking of Saskatchewan.(2) We must remember that what we need is intelligent common sense and not the artificially, fragmented and sophisticated mind set of our business and economic gurus. Kevin Phillips, author of the book "Wealth and Democracy: A Political History of the American Rich", writes today in the New York Times

What Kevin Phillips says is that our social and economic system has become too sophisticated and that it suffers from a disconnection of what is really needed as creation of wealth; in practice, we don't create wealth simply by playing in the stock market and we don't necessarily create wealth by playing with money either. Phillips reminds us that economics is basically the act of making, growing and transporting things; and economics is not the rationality brought into the Free Market as implied by Alan Greenspan's well noted expression

Few days ago I wrote an article and I criticized the relentless message of

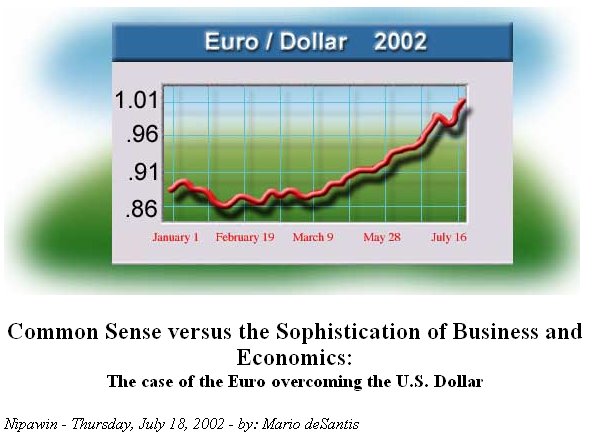

So, the bottom line for ordinary people is to learn how to live with ambiguities while our gurus and their patrician friends do our thinking for us and dictate their inconsistent and sophisticated economics. It was while navigating the Internet that I found the best description for our inconsistent and sophisticated economics science, that is "on the other hand economics." It is really a laugh listening to our gurus and understand that they speak a lot and mean nothing. So, as you listen to our business gurus don't feel overpowered by their sophisticated speeches as their bubbling is no different from the bursting bubbles of the stock market. Lately, the Euro currency has overcome the U.S. Dollar and the following are two examples on how "on the other hand economics" explains this phenomenon:

We don't need a strong or a weaker U.S. dollar. What we need is just intelligent common sense. Is it right to have a strong U.S. dollar and rape the resources of other weaker countries while the American economy continues to maintain a chronic foreign trade deficit and while the American economy requires $1.1 billion of overseas cash each day to finance its $400 billion deficit?(7) Non conformist economist Dean Baker expressed his intelligent common sense two years ago as he suggested that a lowered value of the dollar

References (1) Testimony of Chairman Alan Greenspan Federal Reserve Board's semiannual monetary policy report to the Congress Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, July 16, 2002 http://www.federalreserve.gov/boarddocs/hh/2002/July/testimony.htm (2) Fraudulent SGI and the Sapping, Sacking and Downsizing of Saskatchewan By Mario deSantis, June 25, 2002 http://www.ftlcomm.com/ensign/desantisArticles/2002_600/desantis664/sappingNsacking.html (3) The Cycles of Financial Scandal By Kevin Phillips, July 17, 2002, The New York Times http://www.nytimes.com/2002/07/17/opinion/17PHIL.html (4) The Challenge of Central Banking in a Democratic Society Remarks by Chairman Alan Greenspan At the Annual Dinner and Francis Boyer Lecture of The American Enterprise Institute for Public Policy Research, Washington, D.C. December 5, 1996 http://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm (5) Corruption in Corporate (North) America: the sky is truly falling, trust no one By Mario deSantis, July 12, 2002 http://www.ftlcomm.com/ensign/desantisArticles/2002_600/desantis669/corruptCorpAmerica.html (6) ANALYSIS-Could dollar slide vs euro, yen turn to rout? By Sumeet Desai, July 16, 2002, Reuters News Service http://www.forbes.com/business/newswire/2002/07/16/rtr662715.html (7) O'Neill backs strong dollar Treasury Secretary says euro has only regained half its original value in latest runup. CNN/Money, July 16, 2002 http://money.cnn.com/2002/07/16/news/economy/oneill.reut/index.htm (8) Double Bubble: The Implications of the Over-Valuation of the Stock Market and the Dollar by Dean Baker, Center for Economic and Policy Research, June 2000 http://www.cepr.net/columns/baker/double_bubble.htm |