Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

Few days ago, Sheila Steele, publisher of injusticebusters.com, expressed her concerns on the recent economic role of the banking system and asked me if I could provide some clarifications in this regard. I don’t claim to be an economist, in fact I keep away from economic traditional thinking and I have been using the term ‘intelligent common sense’ as the only way to appreciate our economic realities. The banking system performs a useful function in facilitating the exchange of goods and services within our local and global interconnected economies. However, it is my contention that in the last decade the banking system loosened up this important intermediary economic function and created too much money. The Initial Public Offering (IPO) of new corporations have raised ever increasing capital, huge loans have been used to sustain unprecedented acquisitions and mergers, and a sustained environment for buying stock was artificially manufactured by investment banks. Yes, corporate greed has been the culprit for the increasing

economic gap between the rich and the poor, and the banking and

investment system must be blamed along with the Enrons and Worldcoms

of our global economies.

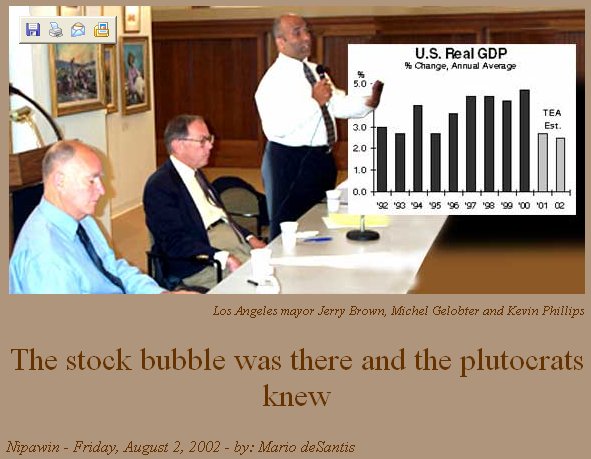

The U.S. real Gross Domestic Product (GDP) grew at a rate of some 4% during the 90’s, yet sociologist Kevin Phillips points out "The total value of stock ranged from 30 percent of GDP to 90 percent of GDP as the economy expanded and contracted after 1925. That is, until 1994 and 1995, when stock values began an unprecedented ascension that reached 225 percent of GDP in 2001!" The stock bubble was there, the banks knew, every plutocrat knew, and people at large didn’t know. References The World This Week: America the Plutocracy. The return of voodoo economics. By Alan Bisbort, Published 08/01/02 http://www.newmassmedia.com/nac.phtml?code=har&db=nac_fea&ref=21426 Market Extremists Amok And how best to dethrone them By Kevin Phillips Issue Date: 7.15.02 http://www.prospect.org/print/V13/13/phillips-k.html |