Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

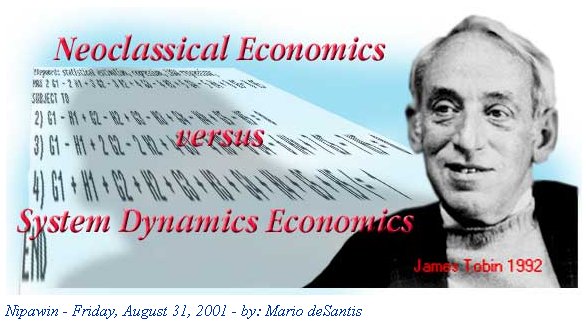

"I still think and say that Keynesian ideas about how the economy works and what policies can make it work better are relevant today" -- James Tobin, 1981 Nobel Prize Winner for Economics Our neoclassical economic science based on the concept that the market will find automatically its equilibrium if left to itself is baloney. And because of this misconception of a natural predisposition for the market to stabilize and provide the best allocation of resources, economists have been building statistical optimization models to find the equilibrium of any subpart of the economic environment. In pursuing the solutions (equilibrium points) of these statistical optimization models, our economists have artificially supported a deterministic approach to our political environment and this is why our politicians have been misdirecting and cheating the people in their economic policies, and especially so in the last 10 years of economic globalization. Economy is a social science where the welfare of people is not measured in mathematical or statistical terms. Therefore, mathematics or statistics must be used as tools to help us be more intelligent and creative; mathematics or statistics must not be used to build economic models, per se, to either predict or determine our future. Three years ago I discovered the field of system dynamics as described by Jay Forrester and I understood how deeply important was Forrester's concept that any system can be imagined in terms of interrelated flows and stocks changing over time ( think of our waters where rivers are flows and lakes are stocks; or think of a company where profits are flows and owners' capital is a stock; or think of our human understanding where learning is a flow and knowledge is a stock...). And I know now that we can use the concept of system dynamics to understand our social and economic environment. While the optimization of mathematical or statistical economic models are focused in finding deterministic solutions or equilibrium points and predict the future, system dynamics models are focused not in predicting the future but in understanding the behaviour of the flows and stocks of the economic system over time. Metaphorically, I associate the word 'telling' to the mathematical and statistical models, and the word 'learning' to system dynamics models. And I can say, my readers, how aggravated I feel when I hear the phrase 'I told you so' and how happier I feel when I hear the phrase 'I am learning.' Few days ago we mentioned of the stupidity of our monetary economists who, disregarding the inertia and time delays intrinsic in the economy, want to use the changing of the central banks' interest rates in order to drive the economy and fight inflation. And yesterday, as I was researching on the 'Tobin's tax' as a means to reduce the speculative components of international transactions on foreign currencies, I was heartened to find out this quote by Nobel Prize Winner Economist James Tobin

We must get rid of the speculative interest of our financial environment. One way to offset these speculations would be to play with taxes similar to the one proposed by Tobin. However, a better way to play against these speculations would be to use the simple tool of system dynamics in every facet of our living, beginning with the education of our children. Some references Related social and economic articles published by Ensign JAMES TOBIN, from 'Lives of the Laureates, Seven Nobel Economists' Edited by William Breit and Roger W. Spencer, The MIT Press, Cambridge, Massachusetts, London, England, 1986 http://cowles.econ.yale.edu/archive/people/tobin/lives86.htm EDITORIAL: Tobin Tax time, Twenty-five years ago, Nobel Prize-winning economist James Tobin proposed a modest tax on speculative financial transactions. http://www.policyalternatives.ca/publications/articles/article185.html The System Dynamics Society, http://www.albany.edu/cpr/sds/ System Dynamics / Systems Thinking Mega Link List, by Günther Ossimitz http://www-sci.uni-klu.ac.at/~gossimit/links/bookmksd.htm |