Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

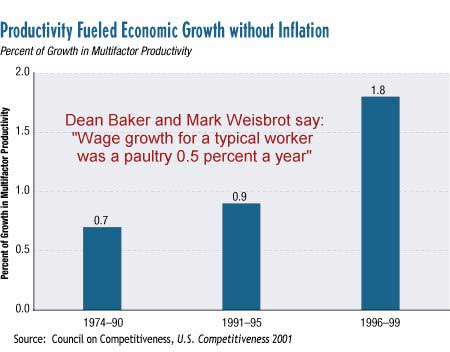

We are learning as we relate to each other in a circular fashion, that is going over our experiences, learning and then acquiring new experiences and learning again. Metaphorically, our learning is just like navigating (not drifting!) in the vast ocean of information available in the Internet and logically (and quite often accidentally) hyperlinking from one web page to the next as we look for new related web pages and as we go back to the old web pages for the purpose of making some sense of whatever we discover. Yesterday, late in the morning, I was writing about our supposed great men who make history, and I pointed out that very often these great men can be wolves dressed up in sheep's clothing, such as the case of Dr. Henry Kissinger who wins the Nobel Peace Prize while at the same time being fingered as a criminal against humanity. I concluded this writing by saying "there are many more myths to tear down as we work to reclaim our democracy." Yes, there are many and many more myths to tear down as last night I received the article "New Economy Cycle Ends, But Myth Persists" by economists Dean Baker and Mark Weisbrot, and as few minutes ago I listened to US Attorney General John Ashcroft saying that since we are at war he cannot release the names of the many people detained as a consequence of the horrific September 11 attacks. I am asking myself "Was this war against terrorism declared by Congress as per the US Constitution?" We are becoming all brainwashed by the existence of many myths and by the use of a distorted language, and therefore we must be aware of both our deceptive politicians and our whitewashing corporate media. We must be clear in our thoughts before taking any action. Yesterday, responding to an editorial article of the National Post supporting the dollarization of the American currency for Canada so that we can enjoy a productivity growth equal to the US, I re-emphasized that the notion of productivity is worthless in the absence of having people employed. And today, I want to quote Dean Baker and Mark Weisbrot on what they think about this American Productivity Myth which was supposed to be behind the economic boom of the 90s: All that new investment caused productivity to grow by leaps and bounds. Since productivity the amount of goods or services that an hour of labor can produce is the basis of economic growth, this raised incomes across the spectrum. The virtuous circle was completed by the response of the Federal Reserve: because of the surge in productivity, we are told, the Fed didn't have to worry about rapid growth leading to accelerating inflation. Thus the Fed was able to lower short-term rates, and allow for a record-long expansion, with unemployment falling to a 30-year low of 3.9 percent. Sounds plausible, doesn't it? And familiar. Now let's look at the numbers. Over the course of the business cycle, real (inflation-adjusted) interest rates on mortgages and high-grade corporate bonds fell by only 0.8 percent. This certainly doesn't look like enough to stimulate an investment or housing boom, and it wasn't. Housing barely increased at all, as a percentage of the economy. And if we look at both investment components of GDP (investment plus net exports), the investment share actually declined slightly. Productivity growth did increase, as compared to the business cycle of the 80s. But it was still considerably lower than the growth of the 50s and 60s business cycles. If we adjust for the increased share of output that was used up in more rapid depreciation mostly computers and software the productivity growth of the 90s cycle does not even beat the 70s. And wage growth for a typical worker was a paltry 0.5 percent a year. So much for the "new economy."

Reference: |