Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

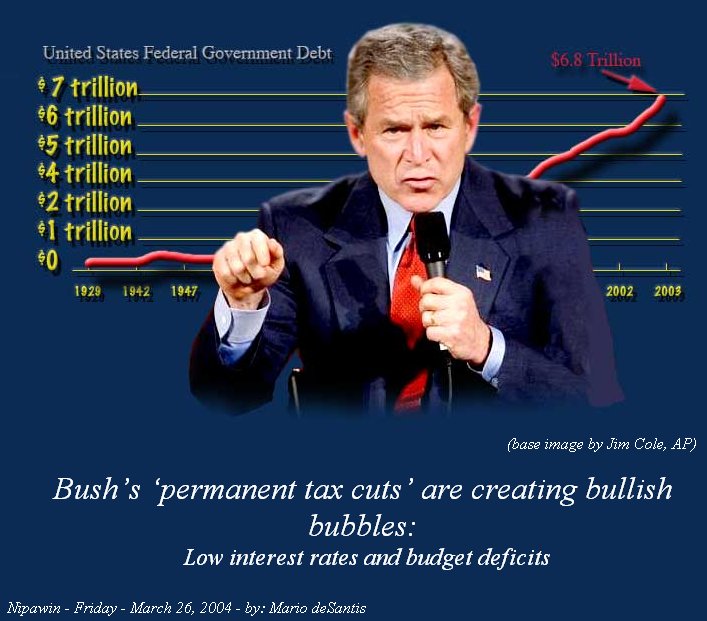

"Here at home, my economic advisors, economic team presented a very upbeat assessment about our economy. It's strong, and it's growing stronger. Inflation is low. Interest rates are low. Manufacturing activity is up. The job base is growing… We need to make sure that we have legal reform… we need to make sure the tax cuts are permanent."--President George Bush In my last article on the anniversary of Bush war in Iraq I outlined the incompetence of the Bush administration in understanding terrorism and terrorists. The incompetence of Bush’s foreign policies has been covered up with the ideology of "you are with us or against us." At the same time, the consistent incompetence of Bush’s economic policies has been covered up with the ideology of "permanent tax cuts." Bush’s ideologies can be summarized with what we commonly understand as the bullish behaviour of "my way or the highway." The bullish behaviour of the Bushes of this world is the culprit of our own social problem, of war, poverty, hunger, violence and terrorism. This bullish behaviour is intrinsic in the ideology of the Free Market, that is, freedom for the Bushes, but enslavement for common people at large. As Bush is incompetent in understanding terrorism, so he is incompetent in understanding our social and economic growth. I express below some current concerns of Bush’s America in the hope, again, that our own thinking and understanding will help break down the myth of the insane ideology of "permanent tax cuts."

References The author, Mario deSantis, doesn’t subscribe to the use of econometric models in the area of broader economic public policies White House Remarks by the President After Meeting with the Cabinet March 23, 2004 http://www.whitehouse.gov/news/releases/2004/03/20040323-5.html deSantis, Mario One year after Bush’s war in Iraq: The building of the ominous ideology "you're with us or against us" March 23, 2004 Ensign 1. Weisman, Jonathan Link Between Taxation, Unemployment Is Absent (PDF) March 15, 2004 Washington Post, http://www.washingtonpost.com/wp-dyn/articles/A58658-2004Mar14.html 2. Center on Budget and Policy Priorities Tax Cuts Are The Single Largest Way Policymakers Have Increased Deficits Revised February 1, 2004 http://www.cbpp.org/1-28-04bud.htm 3. Center on Budget and Policy Priorities TOO GOOD TO BE TRUE: "Tax cuts don’t need to be paid for [with offsets] — they pay for themselves." Revised March 22, 2004 http://www.cbpp.org/3-19-04tax.htm 4. McLaughlin, Abraham As US cuts taxes, states hike them: New York's $2 billion-plus tax hike is just the latest of several overhauls that could recast the social safety net (PDF) May 28, 2003 The Christian Science Monitor, http://www.csmonitor.com/2003/0528/p01s02-usec.html 5. Fram, Alan Republican Still Think They Can Cut Taxes & Reduce Deficits (PDF) March 18, 2004 Associated Press, http://www.capitolhillblue.com/artman/publish/article_4250.shtml 6. DiMartino, Danielle U.S. Debt Burden Is Higher Now than During Depression, Study Says (PDF) March 15, 2004 The Dallas Morning News, http://www.miami.com/mld/miamiherald/business/national/8192892.htm 7. Reich, Robert B.In The Interest Of Interest March 17, 2004 Marketplace®, http://tompaine.com/feature2.cfm/ID/10110 8. Weisbrot, Mark Is the Fed Playing Election-Year Politics? March 22, 2004 Knight-Ridder/Tribune Media Services, http://www.truthout.org/docs_04/032404I.shtml 9. McKenna, Barrie Low rates fuel fears in U.S.: Analysts warn of asset bubble from hot housing market (PDF) March 20, 2004 The Globe and Mail, http://www.theglobeandmail.com/servlet/ArticleNews/TPStory/LAC/20040320/RFED20/TPBusiness/TopStories 10. Buttonwood Crude arguments: Markets should worry about the surging oil price (PDF) March 23, 2004 The Economist Global Agenda, http://www.economist.com/agenda/displayStory.cfm?story_id=2534075 11. Baker, Dean Profits Shares Hit Record High In 2003: THE TAX SHARE OF CORPORATE PROFITS IS NEAR ITS POST-WAR LOW (PDF) March 25, 2004 http://groups.yahoo.com/group/baker-data-commentary/message/163 |