Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

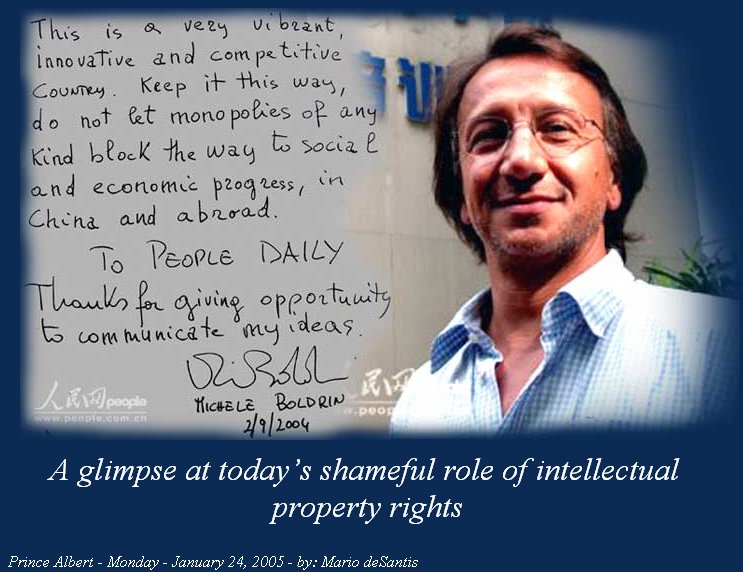

"We argue that not only would innovation thrive in the absence of intellectual monopoly [intellectual property rights], but that we would enjoy greater growth and prosperity in its absence."--Michele Boldrin and David K. Levine, Professors of Economics [1] One of American economic problems has been the increasing privatization of its economic infrastructure and to its consequential regressive changes to a Rental Economy which includes the making of money through intellectual property rights. Congress has been informed recently that the U.S. has lost 1.5 million jobs since 1989 because of increased trade with China.[2] The U.S. experiences some $150 billion annual trade deficit with China and therefore the Bush administration has been asking China to strengthen the yuan so that the import of Chinese goods become more expensive while the export of American goods become less expensive.[3] But the strengthening of the yuan would not have the effect to critically reduce the trade gap since Chinese labour costs, in the order of $1.00 per hour, are a fraction of the American costs and since the transformed American Rental Economy, with a lower manufacturing sector,[4] cannot produce the required goods to export to China. What is incredible is that the U.S.-China trade deficits feeds the U.S. budget deficit as China buys U.S. Treasury bills and bonds.[5] As the multinationals have used the WTO’s (world trade organisation) protections of their investments and intellectual property rights to move their production facilities to China so globalization has slanted the economic playing field in favour of investors and owners of intellectual property rights at the expense of American jobs and wages.[6] I am at a loss when I learn that American marketeers accuse China of unfair trade practices as a major reason for the huge overall U.S. trade deficit which was $60.3 billion for the last month of November.[7] For example, the U.S. Department of Commerce has estimated that American companies, as a result of counterfeiting and piracy, lose between $20 billion and $24 billion annually with China. Yet, disregarding the abuses of the U.S. drug industry,[8] economist Dean Baker has stated that the savings the government and consumers would have experienced in 2,000, if prescription drugs had not been subject to patent protection (ie. intellectual property rights), would have been between $72.8 and $89.6 billion.[9] Intellectual property rights must be changed as to allow a more competitive and innovative global market place and especially so to allow the economic take off of poor countries which are currently strangled by foreign debt repayments.[10] In my own province of Saskatchewan, we have lawyers who have been furthering the privatization of their work by invoking their fictional intellectual property rights.[11] It is a shame that today we must stifle innovation and creativity with the legal protection of twisted and fictional intellectual work. References 1. Boldrin, Michele and David K. Levine Against Intellectual Monopoly 2004 Chapter 1: Introduction, Page 4 http://www.dklevine.com/papers/ip.ch.1.m1004.pdf 2. Thornton, Philip Congress told 1.5m jobs lost to China January 12, 2005 The Independent, http://news.independent.co.uk/business/news/story.jsp?story=599987 (subscription required) 3. CNN.com U.S. to press China over piracy January 10, 2005 http://edition.cnn.com/2005/BUSINESS/01/09/china.trade.ap/index.html 4. Roach, Stephen Global: The Dollar Can’t Do It Alone January 14, 2005 MorganStanley, http://www.morganstanley.com/GEFdata/digests/20050114-fri.html 5. Ariff, Mohamed Global impact of US economic woes January 17, 2005 The Star Online http://biz.thestar.com.my/news/story.asp?file=/2005/1/17/business/9869898&sec=business 6. Mekay, Emad S Dragon's 'giant sucking sound' jolts US January 13, 2005 Asia Times http://www.atimes.com/atimes/China/GA13Ad07.html 7. Fishman, Ted C. Manufaketure January 9, 2005 New York Times, http://lists.econ.utah.edu/pipermail/marxism/2005-January/019289.html 8. Tansey, Bernadette Concerns over safety undermine FDA : Serial upsets over drugs on the market depress pharmaceuticals December 26, 2004 San Francisco Chronicle http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/2004/12/26/BUG16AFILT1.DTL&type=printable 9. Baker, Dean and Noriko Chatani Promoting Good Ideas on Drugs: Are Patents the Best Way? October 11, 2002 CEPR http://www.cepr.net/promoting_good_ideas_on_drugs.htm 10. Democracy NOW The Debt Threat: How Debt is Destroying the Developing World January 13, 2005 http://www.democracynow.org/article.pl?sid=05/01/13/1455234 11. Letter dated January 14, 2004 directed to Mario deSantis from lawyer Gregory Willows, Regina, Saskatchewan. Mr. Willows claims the status of "without prejudice" and "copyrights" for this unusual letter. |