Learning Stories

by

Mario deSantis

mariodesantis@hotmail.com

“I am a Canadian, free to speak without fear, free to worship in my own way, free to stand for what I think right, free to oppose what I believe wrong, and free to choose those who shall govern my country.” - -The Rt. Hon. John Diefenbaker, Canadian Bill of Rights, 1960

“The whole judicial system is at issue, it's worth more than one person.”--Serge Kujawa, Saskatchewan Crown Prosecutor, 1991

“The system is not more worth than one person's rights.”--Mario deSantis, 2002

Ensign Stories © Mario deSantis and Ensign

|

|

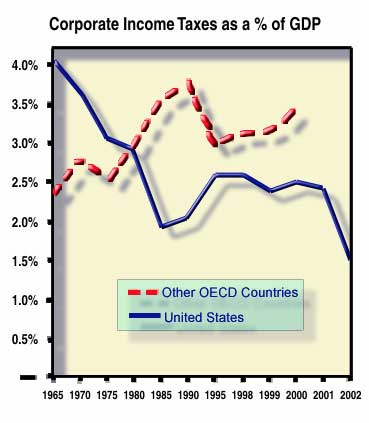

The United States is the military only hyper power of the world and its hegemonic economic influence on other countries has had radical and detrimental effects. It is for this reason that I focus my attention on the policies of this administration. In the last few decades, the push for globalization and privatization of the global economy has accelerated to a frenetic pace. Every country is peddling the economic philosophy of the Free Market and every country has been following the policies of further tax cuts and further privatization. The natural question is this: do tax cuts produce bigger GDP numbers?

In 2002, U.S. corporate taxes plummeted to only 1.5% of GDP The financial wealth of the top 1 percent of U.S. households now exceeds the combined household financial wealth of the bottom 95 percent. Do some critical thinking in regard to the above statistics, and whenever we consider the experienced corruption of Corporate America I am asking if instead of cutting personal taxes we should increase corporate taxes? It is a nightmare and it is a conspiracy, and we can't see it as we are economically competing against each other and have no time to think for ourselves. We have the latest news that the White House values politics over domestic policies, and this is not new news for me, as effective public policies are chronically shortchanged for the politics of immediately making money, that is, Bush's tax cuts and further privatization. But no wait, let us not forget the compassion of our rightist conservatives as they are hypocritically supporting tax increases for the poor as the Lucky Duckies‚ pay little or nothing in income taxes. References Weisbrot, Mark , Dean Baker, Egor Kraev and Judy Chen The Scorecard on Globalization 1980-2000: Twenty Years of Diminished Progress, by July 11, 2001 http://www.cepr.net/globalization/scorecard_on_globalization.htm International Tax Comparisons, 1965-2001 (federal, state & local) Citizens for Tax Justice, 202-626-3780 November 5, 2002 http://www.ctj.org/html/oecdtax.htm Molly Ivins: Enron: Think Bigger 3/1/2002 http://www.texasobserver.org/showArticle.asp?ArticleID=575 Ivins, Molly, Republicans reward tax evasion, November 28, 2002 http://www.thehollandsentinel.net/stories/112802/opi_112802019.shtml Ex-Aide Insists White House Puts Politics Ahead of Policy (PDF) The New York Times, December 2, 2002 http://www.nytimes.com/2002/12/02/politics/02BUSH.html http://www.ftlcomm.com:16080/ensign/ensign2/pdfarchive/NYtimeswhitehousepolicy.pdf The Corporate Corruption Administration http://www.thedubyareport.com/enron.html Krugman, Paul, Hey, Lucky duckies!, (pdf) December 3, 2002, New York Times http://www.ftlcomm.com:16080/ensign/ensign2/pdfarchive/NYTimes_LuckyDuckies.pdf |

I

am the first person to say that bigger GDP numbers have no

proportional direct cause on our economic welfare, but taking for

granted that bigger GDP numbers equate bigger wealth, I don't agree

that tax cuts produce bigger wealth. Economists at the Center for

Economic and Policy Research have shown the last two decades to be

years of diminished progress, and as the United States is concerned,

I want to provide the following economic statistics: In 1965, U.S.

corporate income taxes were 4.1% of GDP

I

am the first person to say that bigger GDP numbers have no

proportional direct cause on our economic welfare, but taking for

granted that bigger GDP numbers equate bigger wealth, I don't agree

that tax cuts produce bigger wealth. Economists at the Center for

Economic and Policy Research have shown the last two decades to be

years of diminished progress, and as the United States is concerned,

I want to provide the following economic statistics: In 1965, U.S.

corporate income taxes were 4.1% of GDP